Where fresh ideas meet trusted protection.

he whakaaro hou, he kaupare kau

Practical advice, real support, and insurance that’s right for you.

Your Plan A Starts Here

This free eBook is your local coach’s guide to building momentum. one step, shuffle, or jog at a time. Think of it as your nudge to move, protect your energy, and back yourself with a solid Plan A.

Services

-

Medical insurance lets you fast-track the public health system, so if you’re injured or unwell, you’ll have a shorter wait for treatment.

-

If you’re unable to work due to illness or injury, Income & Mortgage Cover gives you access to an ongoing income. ACC doesn’t cover illness, so you aren’t able to receive ACC payments if you become unwell.

-

Trauma Insurance provides a lump sum payment in the event you suffer from a serious illness. It means you won’t have to rush your return to work or worry about money whilst you’re getting back to full health.

Learn More > -

If an accident or injury means you can’t keep doing the job you love, TPD insurance gives you access to a lump sum payment.

-

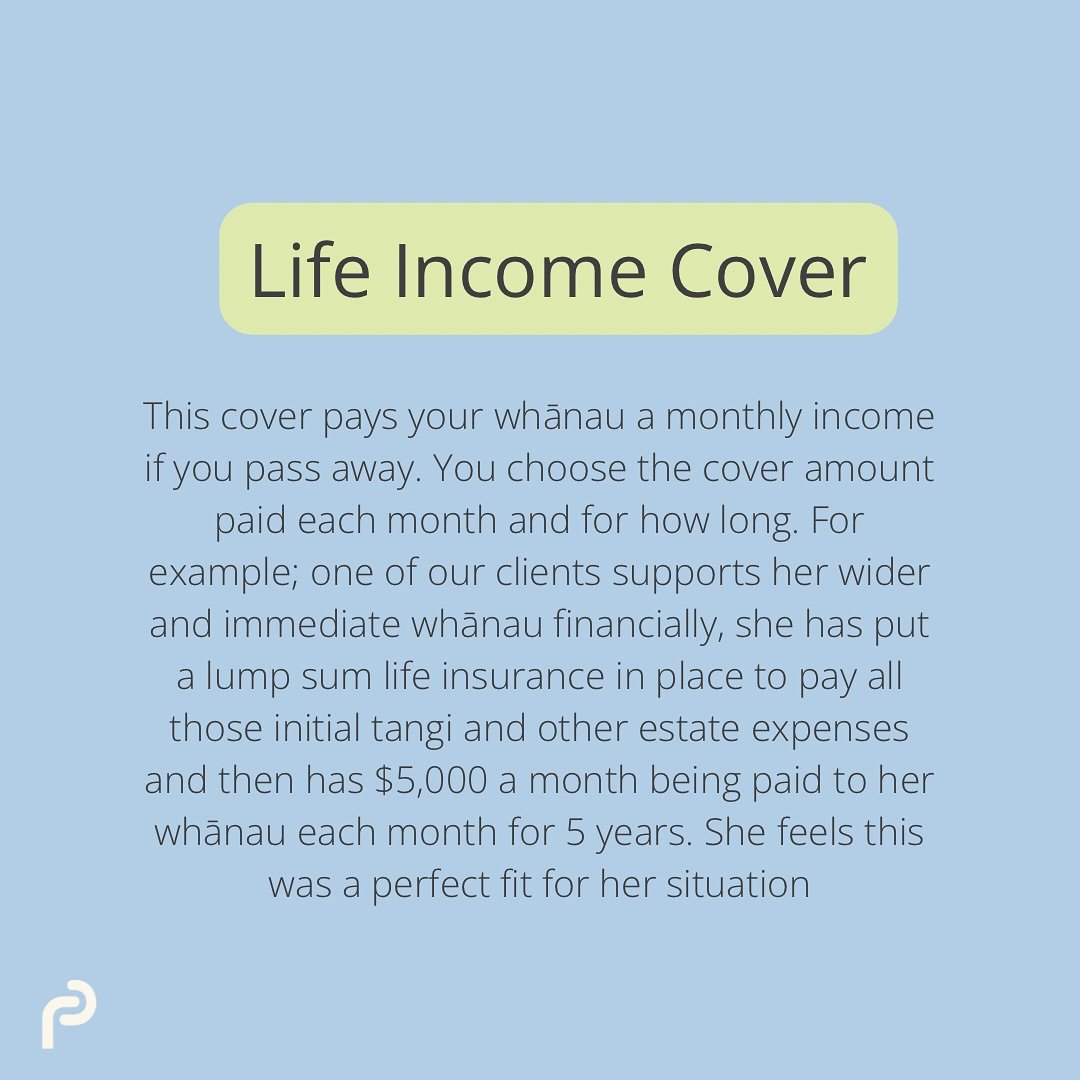

Life insurance takes care of those left behind by reducing the financial impact of a loss. It’s something you put in place to make sure your loved ones will be OK if you pass away.

Learn More >

We started R&P Insurance to positively impact our industry and make the conversation around insurance more comfortable for everyday Kiwis.

Introducing Wāhine Wanawana - Ara ki Angitu. A not-for-profit movement by wāhine, for wāhine, to empower financial success and well-being in our communities.

Women tell us time and time again that they don’t feel confident in seeking financial advice and the lack of diversity in the industry makes them feel under represented and misunderstood. We are here to change that.

Juggling work, life, and family doesn't leave much time to think about insurance.

We're here to ease the pressure by offering tailored insurance recommendations for your family and lifestyle.

Our team streamlines the application process, making it quick and easy, while providing the information you need to make the right decisions.

At its core, insurance exists to keep the things you care about safe. We're passionate about helping our clients achieve just that by putting a Plan B in place whilst living Plan A.

Let's chat – over coffee, phone, Zoom – wherever you are in Aotearoa, we can help.

What our clients are saying

We’re passionate about providing a fresh, flexible, female approach - no judgment, no jargon, and minimal paperwork.

Over 90% of R&P clients identify as Wāhine.

Over 35% identify as Māori or Pasifika.

95% of our clients confirmed their insurance knowledge improved significantly once completing their insurance review.

Our clients live all over Aotearoa.

FAQ’S

-

In an Insurance conversation, price is often the elephant in the room! It is our job to listen to you, understand what is important to you and recommend cover that fits. We’re here to ensure you feel comfortable with your level of cover and your budget.

Whilst we provide advice to you, it is still your cover and we will help you to make informed decisions around your cover.

-

In New Zealand, we’re fortunate that the majority of insurance claims are accepted. When an insurance claim isn’t paid out, this is generally due to nondisclosure (when the person who took out the insurance didn’t provide the right information at the start of the process).

We’re here to help you understand what you need to tell the insurance company and walk you through the process clearly and transparently.

We provide tailored advice on personal and business risk.

Keep up with us

@randpinsurance